Buyers will occasionally ask me whether they can make an offer of 20%, 30% or even 40% less than a listing’s asking price. The expectation is that a motivated seller will take almost any price to get a property sold.

Many low-offer buyers seem sincere in their intent. And they are often astonished when the seller refuses to negotiate with them.

If you are considering making a very low offer, please keep in mind that while home prices in Massachusetts are down, conditions in MA are not nearly as bad as they are in heavily damaged markets in Florida, California and Nevada.

The very low home selling prices in other parts of the US you may be hearing about on the national news are not the norm in Massachusetts.

There are other compelling financial and practical reasons why home sellers reject very low offers.

• Low Equity

The vast majority of home sellers carry mortgages. Many sellers have low home equity. They often want a high enough price to cover their mortgage and the expenses of selling.

They simply lack the equity to pay off their mortgage liens at a selling price 20% or 30% off the asking price.

• “Negative Equity”

Where a homeowner is in financial distress and owes more on a property than the home is worth, he may try a short sale.

But with short sales, the mortgage lien holder(s) can veto the sale. The lenders often will not consent to a sale at a steep discount off the asking price.

I recently had a short sale listing where one buyer offered 17% off asking while another buyer offered 36% off asking; the lender involved turned both of these buyers down flat.

If you make a heavily discounted offer on a short sale, you might waste weeks waiting to see if the lender will approve the sale, only to be told “no”.

• Bank-owned “REO” listings

When a lender forecloses on a home, the property is placed on the market as a REO (bank owned) listing.

REO lenders have a strong financial incentive to maximize the selling price on homes they own.

At least in the regional real estate market surrounding Franklin, MA, I have not seen REO lenders willing to sell at steep discounts off asking price.

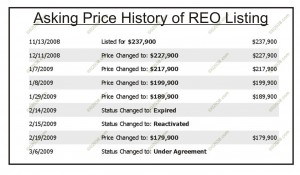

The REO listing history shown below is from an actual listing on the MLS and is pretty typical:

When a bank-owned REO property does not sell quickly, the REO lender often will start a series of asking price reductions over time until the house does find a buyer, but that price reduction process can take months.

The REO price history shown above details how the REO lender listed the home at $237,900 on November 13, 2008. It took the lender several months to finally reduce the asking price down to $179,900, the price at which the home eventually went under agreement.

Making an offer well below asking on a REO property typically will not work in Massachusetts, at least in more desirable communities!

Practical Reasons Most Sellers Reject Very Low Offers

There are many home sellers in Massachusetts who are not in financial distress. Quite a few of them have substantial equity in their homes.

You’ll very likely find that even home sellers with good equity won’t typically deal with offers substantially below asking price, at least not early in the life of the listing.

Sellers with equity often need to buy another home with the sale proceeds or have other plans for the money.

Selling at a huge discount off asking price would deny these sellers the cash to consummate their next home purchase or achieve their other goals.

These sellers often lack the desire to negotiate low offers.

So in conclusion, the typical home buyer in Massachusetts should not have the expectation that offers 20%, 30% or more off asking price will be productive.

Copyright ©2009 02038.com