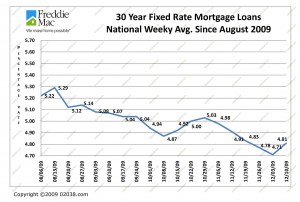

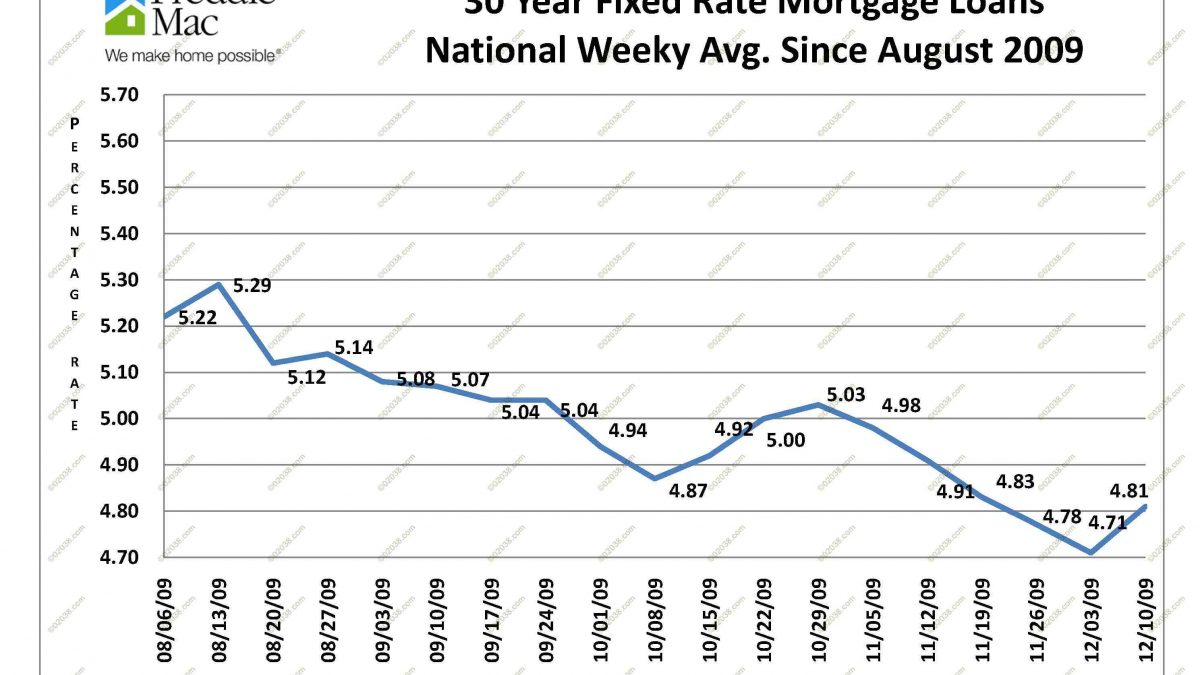

Low mortgage rates are causing a spurt in mortgage applications this December. 30 year fixed rate loans averaged 4.81% this week, continuing a year-long run of historically low mortgage interest rates.

Freddie Mac reported on Thursday that the average interest rate for 30 year fixed rate mortgages remained below 5% for the sixth straight week.

Federal Reserve keeps mortgage rates low

One of the reasons behind such consistently low mortgage rates in 2009 is the Fed’s massive purchases of mortgage backed securities this year. Back in March 2009, the Federal Reserve announced that it would buy up to $1.25 trillion in mortgage-backed securities in 2009.

The stated goal behind this market intervention was to support the US housing market by keeping mortgage rates low and increasing the supply of funds available to mortgage lenders.

Mortgage applications rise

Borrowers are acting this December to take advantage of the low rates.

The Mortgage Bankers Association (MBA) maintains a number of mortgage application indexes which measure a variety of mortgage loan application volume. In a press release dated December 9, 2009, the MBA said its Market Composite Index, a measure of mortgage loan application volume, increased 8.5 percent on a seasonally adjusted basis from one week earlier.

Purchase money mortgage loan applications rose 4 percent last week, while refinance applications shot up 11 percent from the prior week, according to the MBA.

Local housing market active

Low mortgage rates are keeping the local real estate market humming this December.

Speaking informally just from my personal experiences as a real estate broker this month, there are quite a lot of buyers actively looking and buying homes in Franklin and surrounding towns despite the Holiday season.

Attendance at open houses has been strong. New listings are selling briskly if the price is attractive.

Quite a nice change from the situation last year at this time when experts were announcing the advent of the next Great Depression!

Copyright ©2009 02038.com