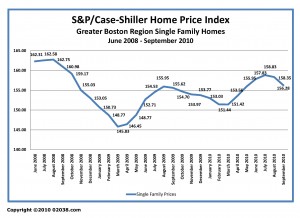

Greater Boston single family home sale prices have declined almost 2% since peaking last May, according to data issued yesterday by Standard and Poors.

Decline follows end of Federal tax credits

The 1.92% drop in the seasonally adjusted version of the S&P/Case-Shiller Home Price Index for Boston has come on the heels of the expiration of the Federal home buyer tax credit programs last April. It seems fair to lay the blame for the current home price weakness directly at the feet of the late Federal home buyer tax credit programs.

The Massachusetts real estate market became markedly weaker in the second half of2010 at least partly because home buyers accelerated their home purchases early this year. Many buyers rushed to buy homes before April 30 in order to qualify for the home buyer tax credits before the programs ended April 30.

Bolstered by the home-buying demand created by the Federal home buyer tax credits, Boston area home prices had risen a solid 5.28% by May 2010 from the market low back in April 2009.

But as soon as the Federal home buyer tax credit programs ended in April, the MA real estate market started to wither. Since May 2010, seasonally adjusted single family home sale prices in Greater Boston have fallen 1.92%

Housing demand cannibalized unintentionally

In retrospect, the Federal home buyer tax credit programs had the unintended consequence of cannibalizing housing demand, making the current real estate market much weaker than it might otherwise have been.

During their existence, the tax credits artificially bolstered both Massachusetts home sales and home sale prices by pulling demand from the second half of 2010. The 2009–early 2010 market was inflated essentially at the expense of current the real estate activity.

Housing slumps as US economy gains strength

The most recent decline in the seasonally adjusted S&P/Case-Shiller Home Price Index for Boston was announced by Standard and Poors at the same time that some notably upbeat economic data was being released:

GM reports large rise in US car sales

US manufacturing continues expansion

Stocks up on good economic news

Prospective home buyers should buy now?

If you’re planning to buy a home sometime over the next year or so, you might want to take heed of the above-described strengthening of the US economy.

The current downtrend in MA real estate appears to have been at least partially induced by the unintended consequences of the late Federal home buyer tax credit programs.

If the US economy continues its revival in 2011, you may see mortgage interest rates rise and home sale activity pick up. You might be wise to buy a home now while rates are very low and housing demand remains artificially depressed.

Adjusted home sale prices more accurate

Finally, please note that I will be reporting in coming months on Greater Boston home prices using the seasonally adjusted Case-Shiller Home Price Index for Boston shown above.

The seasonally adjusted Index reproduced above gives a much more accurate picture of how metro Boston home prices are faring than the unadjusted Index I have been using in most of my prior posts on MA home prices.

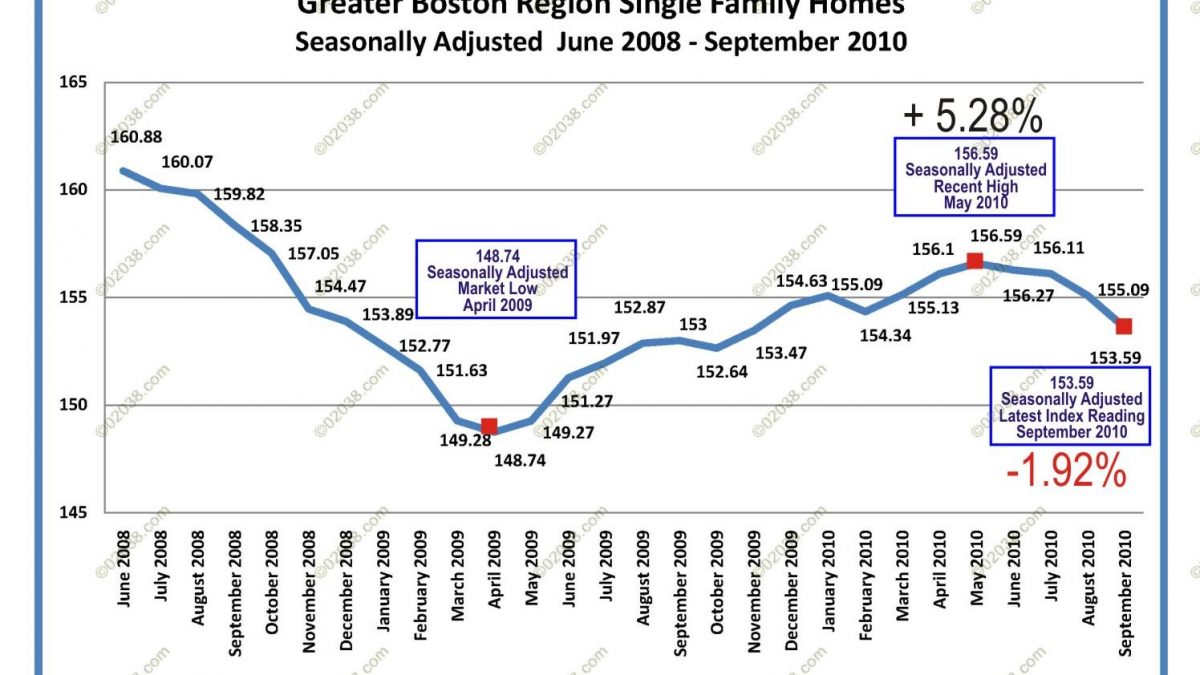

See the strong up and down swings in the unadjusted Boston Index; the seasonal rise and fall in Boston home prices makes it very hard to get an accurate reading on the overall direction of MA home prices:

So for now on, we’ll be focusing most of our attention on greater Boston home prices via the seasonally adjusted version of the S&P/Case-Shiller Home Price Index for Boston.

Copyright ©2010 02038.com