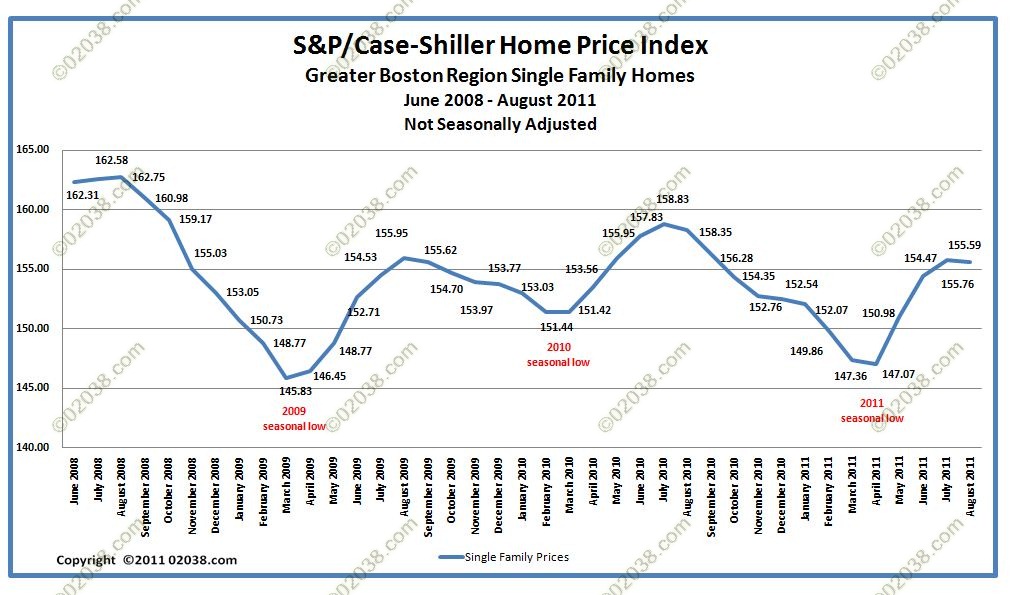

Greater Boston home prices essentially held steady according to the August rendition of the widely-followed Case-Shiller Index for Boston released recently by Standard and Poors. The pause in MA home prices follows a nearly 6% rise in Greater Boston home values over the prior three months, but comes at a time when some are predicting an upcoming “third dip” in property values nationwide.

Greater Boston home prices take a breather

Metro-Boston home prices as documented by the folks at S&P/Case-Shiller were flat in August (down a minuscule 0.1%).

This stability comes on the heels of a cumulative 5.9% increase in the Index from April through June of 2011. The Massachusetts economy has outperformed the US economy for the past few years, helping support local real estate.

The national “third dip” scenario

On October 31, newsfeeds displayed scary headlines predicting an imminent “third dip” for US home values.

The forecast was issued during a CNN/Money interview with the top economist at Fiserv Inc, a company that advises and supports the financial services industry.

In explaining his forecast third dip, the Fiserv economist described the two prior dips in national home values that have occurred since the 2006 market peak.

First dip

![]()

The first dip culminated at the height of the world-wide financial panic; by early 2009 the Case-Shiller National Home Price Index had plummeted 31% off its 2006 high.

Second dip

![]()

The second dip came in mid-2010 after a rebound in US home prices caused by the two Federal home buyer tax credits. After the tax credits expired at the end of April 2010, US home prices began to dip for a second time. All the price gains engendered by the Federal tax credits were eventually lost. The 2009 national market bottom failed to hold as the National Index slipped below where the first dip had left prices in 2009. Home prices fell further and the National Index now finds itself down 33% from the 2006 market top.

Third dip coming?

![]()

Fiserv’s “third dip” forecast sees a additional 3.6% decline in the National Index by mid-2012. Fiserv believes the second half of 2012 will usher in a mild rebound in home values that will extend at least to mid-2013.

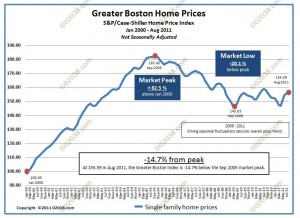

Where MA fits in the “third dip” scenario

The chart below highlights some important differences between what has transpired over the last 5 years or so with Massachusetts real estate as opposed to the US market as a whole:

At their worst, Greater Boston home prices were “only” about 20% off their 2005 price peak, nowhere near the 31% or 33% decline seen in the US as a whole. The Boston Index now stands 14.7% below its September 2005 high.

The relative strength and stability of the MA housing market may lessen the scope of any “third dip” in Massachusetts for 2012 – and might help us avoid one at all.

The chart above also shows the strong seasonal swings up and down that affect the Boston Index. These up and down swings make it hard to spot a “second dip”, much less enable one to predict a meaningful “third dip” with confidence.

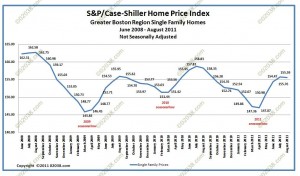

Seasonally adjusted prices show clearer picture

The next chart uses the seasonal adjustments applied by Standard and Poors to the Boston Index. These seasonal adjustments smooth out the price undulations caused by the passing of the New England seasons and give a clearer view of the MA real estate market since 2000:

Here we see the something vaguely approaching a double dip in Greater Boston home prices; but the “second dip” looks very muted.

The chart shows a market peak in 2006, a bit later than the non-seasonally adjusted Index. The following decline (“first dip”) bottomed in early 2009 at the crescendo of the world financial crises.

Greater Boston home prices did rebound in late 2009 through early 2010 just as overall US home prices did. Like the nation as a whole, the local market was buoyed by the stimulation provided by the two Federal home buyer tax credits.

MA market bottom held

Once the tax credits expired at the end of April 2010, the stimulation ended and the Greater Boston Index weakened.

But it was not as severe a decline as that experienced by the National Index.

The moderate decline in MA (a “second dip” if you wish) ended in April 2011. The Boston Index stopped declining at a point just above its low set back in 2009. The Massachusetts real estate market achieved what the overall US housing market could not: MA home prices did not drop below the 2009 low. The 2009 Massachusetts market bottom held.

Since last April, the seasonally adjusted Boston Index has started to rise again.

2012 – 2013 outlook better for MA RE?

The seasonally adjusted Boston Index presents a market that looks like it wants to trend higher.

No one knows what the future will bring. We might well see a weakening in home prices in 2012, followed by a 2013 rebound exactly as forecast by Fiserv.

But it seems likely that the relative strength of the Massachusetts economy will keep conditions in the Massachusetts real estate market markedly better than they are for the US as a whole.

The Massachusetts real estate market seems positioned to outperform the US market as a whole in 2012 and beyond.

Copyright ©2011 02038.com