We witnessed a slew of positive economic news in the middle of December. ABC News declared during one evening broadcast aired the week of December 12 that the corner has been turned on hiring in the US and that a markedly better economy lies ahead for 2012

On December 15 it was announced that weekly jobless claims fell by a much greater than expected 19,000 to the lowest level since 2008. Small business appears to be shouldering the bulk of the hiring. Manufacturing activity also saw sharp rises in December in several regions of the US.

What’s ahead for 2012?

Good economic reports come and go and usually give only a snapshot view of the economy. There’s always a new economic report coming out to potentially muddy our sense of where the economy is really headed.

Since the advent of another new calendar year is typically the time for forecasts for the year ahead, now’s the time to check in on some of the nation’s economic experts to see how the MA and US economy and real estate markets may perform in 2012.

So what do top economists foresee for 2012? See below for the answer . . .

JP Morgan Chase & Co

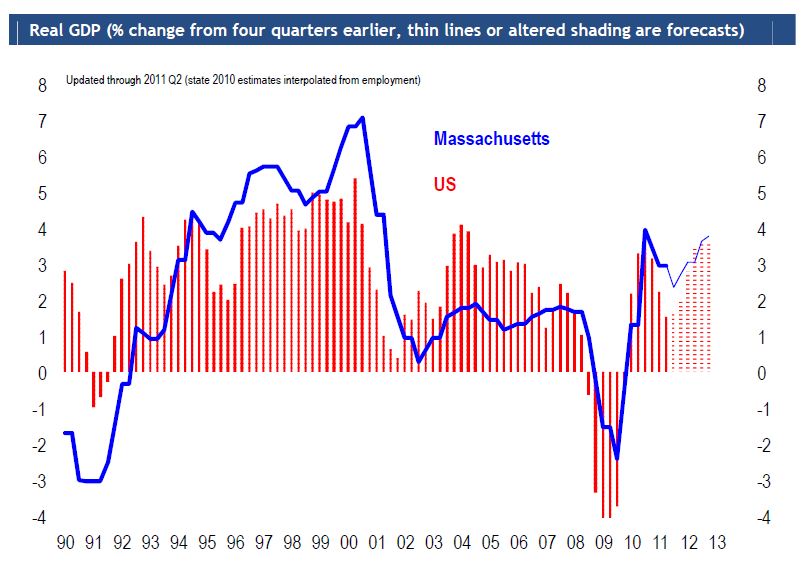

In an excellent 18 page report on the Massachusetts economy, JP Morgan Chase & Co gives a pretty upbeat assessment of how MA has fared since the 2009 economic crises. Chase’s take on the 2012 outlook for MA is much better than what it foresees for the US overall.

The report has interesting charts and graphs – well worth a look. Click the image above or the hotlink to download the .pdf.

Key points made by the Chase economists in the report include:

• Boston’s housing markets are stabilizing, helped in part by the robust high tech sector.

• Massachusetts’ economy appears to be on the rebound . . . and is forecast to fare well into 2012.

• The booming technology sector is a plus for Massachusetts.

• The state enjoys some stability from the outsized footprint in a number of services and technology.

Freddie Mac on the 2012 housing market

The economists at Freddie Mac forecast a modestly improving US real estate market in 2012. Sales should be spurred on by a pickup in consumer purchases and a reduction in unemployment.

Freddie Mac says home prices may dip in the first half of the year but should start a much-looked-for rebound during the second half of 2012:

Click the hotlink or on the image above to download the Freddie Mac publication.

“A full-fledged recovery in the housing sector will likely elude the U.S. in 2012,” Freddie Mac economists said in the report. The report goes on to say that “we expect U.S. house price indexes to move lower before bottoming out in 2012, with modest appreciation forestalled until 2013.”

“Still, these national indexes mask the sizable variation in local house-price performance. Some markets have appreciated over the past year and are likely to gain further in 2012.”

Wells Fargo on US real estate and the global economy

In a detailed, highly insightful, 28 page report, Wells Fargo economists delve at length into the role of housing in the US economy and forecast many sectors of the global economy.

Wells Fargo is a bit more cautious than Chase on both the US economy in general and the overall US housing market for 2012. There may be bumps in the road ahead, especially if Europe enters a bad recession. But the report does note unique strengths in the American economic system that it says should contribute to better times ahead in 2013 and beyond.

You can download the report by clicking on the image above or on the hotlink.

Wells Fargo agreed with the viewpoint of Freddie Mac that US home values may fall more in the first half of 2012 but noted that regional pockets of 2012 housing resiliency exist:

“. . . there are a few bright spots (in US housing). The Northeast continues to do relatively well, particularly Boston and New York” (emphasis added).

Below is a long excerpt from the Wells Fargo report on why America may recover much more solidly than Japan did after the Japanese economic crisis back in the 1990s:

“. . . the U.S. economy has achieved some important milestones that could lead to a better performance over the medium term. The Fed has been much more aggressive in fighting deflationary pressures than the Bank of Japan was in the 1990s, and the impact on the monetary base and inflationary expectations is far more constructive than what happened to Japan in the 1990s. Furthermore, U.S. banks are cleaning up their balance sheets at a rapid pace, which will put them in a better position to increase lending, while asset prices are already back to more sustainable levels that can be supported by fundamentals, such as income and rents. The churn of the labor market is making businesses more productive and more profitable than ever, laying the ground work for more balanced and sustainable U.S. growth ahead . . .”.

What does this all mean for you?

The bottom line in all these economic prognostications for us in MA is that both the Massachusetts economy and real estate market should improve modestly in 2012 and will continue to outperform the US market in general, just as they have for each of the last three years. 2012 may not be a great year for the MA economy and housing market, but it may lay the foundation for better years ahead.

A lot of 2012’s actual performance hinges on Europe. If the Eurozone economies muddle through their current financial problems towards a lasting solution that brings stability, all should go well for the US in 2012. Only if Europe enters a deep recession will America likely experience a 2012 worse than 2011.

Copyright ©2011 02038.com