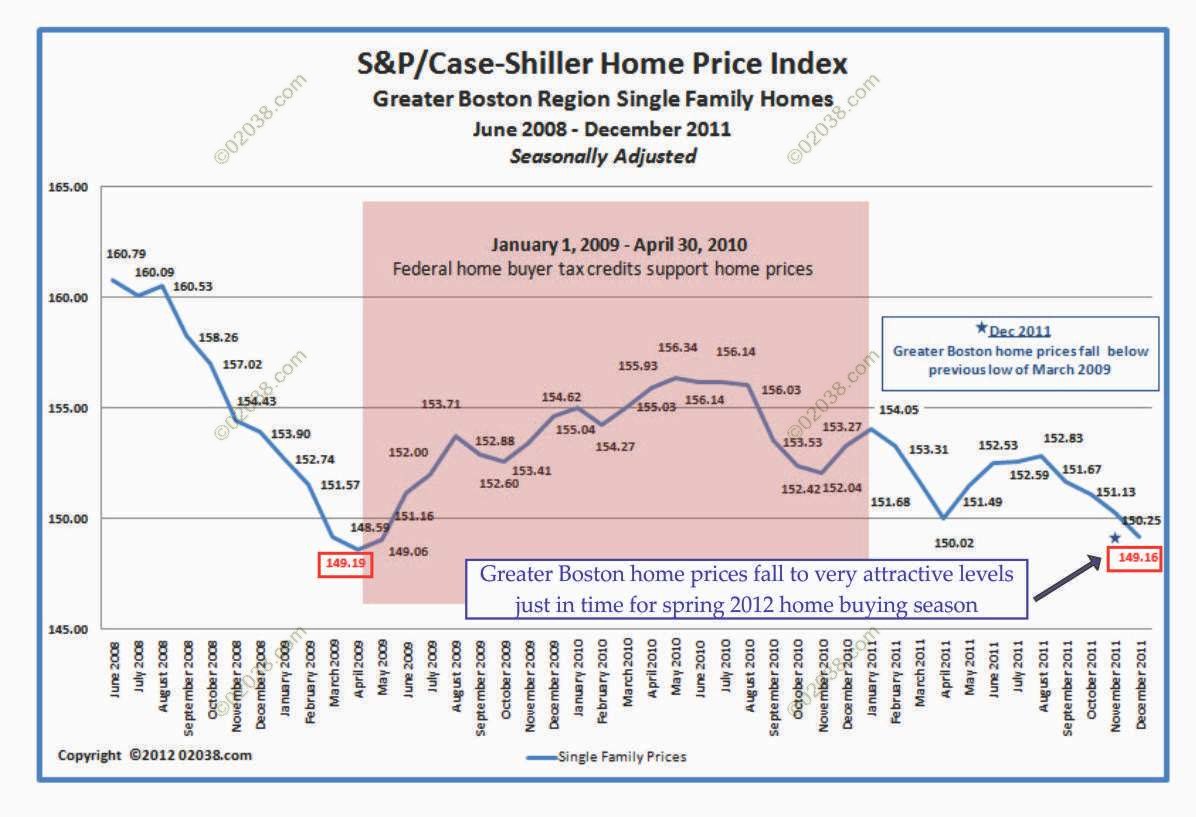

Greater Boston home prices hit a new low in the most recent release of the Case-Shiller Index for Boston. At a reading of 149.16, the Boston Index is now fractionally below its previous nadir seen back in March 2009.

Buying opportunity?

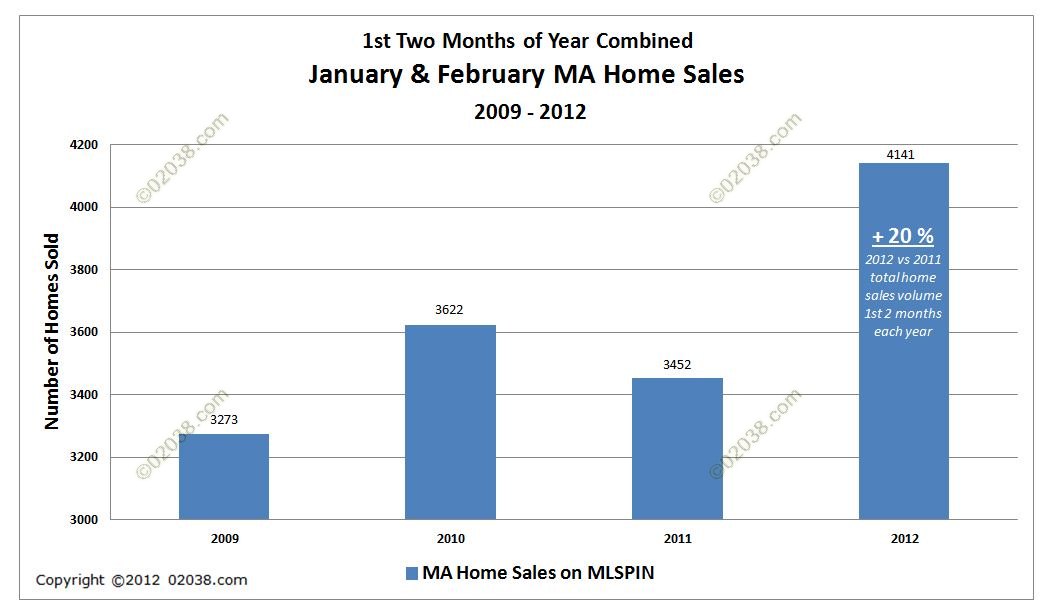

The current weakness in MA real estate prices comes at a time when home sales volume in Massachusetts is soaring.

For the first two months of the year, single family home sales are up 20% over last year. February home sales were especially strong in Massachusetts.

Because an increase in home sales volume often is a precursor of a stronger real estate market, one wonders if the ongoing home price sag represents a buying opportunity.

Warren Buffet recently said he’d be buying homes now.

Pessimists vs. optimists

There’s a lot of uncertainty about the future direction of the real estate market. Here’s a good article that juxtaposes the current opposing positive and negative takes on the US and world economies:

It is always easy to find alarmist, pessimistic views in the news and on the Web.

Robert Prechter, one of the “confirmed pessimists” quoted in the article cited above used to make regular appearances on the old PBS investing show “Wall Street Week with Louis Rukeyser“. On one show, Rukeyser famously dismissed the market negativity then being promoted by Prechter by referring to Prechter’s “Idiot Wave Theory” (instead of its correct Elliott Wave Theory name). And it appears that Prechter’s still at it.

Don’t let uncertainty stop you from investing in your future

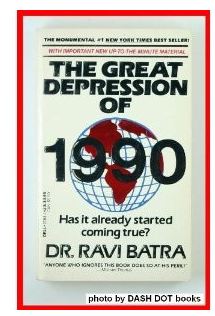

Whether you’re investing in the stock, bond or real estate markets, it’s easy to get swayed by the naysayers. There will always be peddlers of crisis and doom. Anyone remember Ravi Batra’s mid-1980s forecast of the Great Depression of 1990?

His scaremongering sold a lot of books but his forecast was way off target. For that miss, Batra received the “Ig Noble” award for economics in 1993. If you followed Batra’s advice and avoided stocks and real estate, you would have sat on the sidelines throughout the historic run-up in asset values of the 1990s!

My point is that you’ll do better being guided by informed optimists and taking prudent investment risks rather than by letting the doom and gloom crowd scare you into crawling into a financial bunker of inaction.

Markets will go up and they will go down – but nothing stays down forever. Massachusetts home prices are low now. And they are likely to rise in the future.

The odds are that five years from now you’ll be very glad you bought that first home or made that real estate investment in 2012!

Copyright ©2012 02038.com