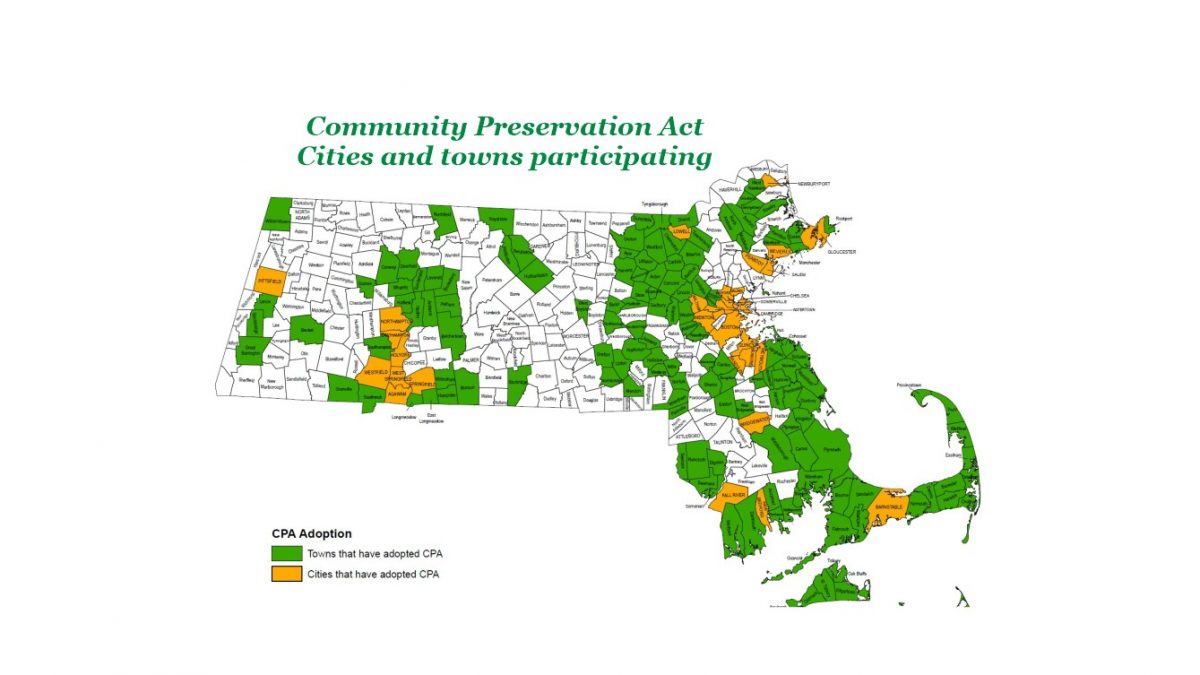

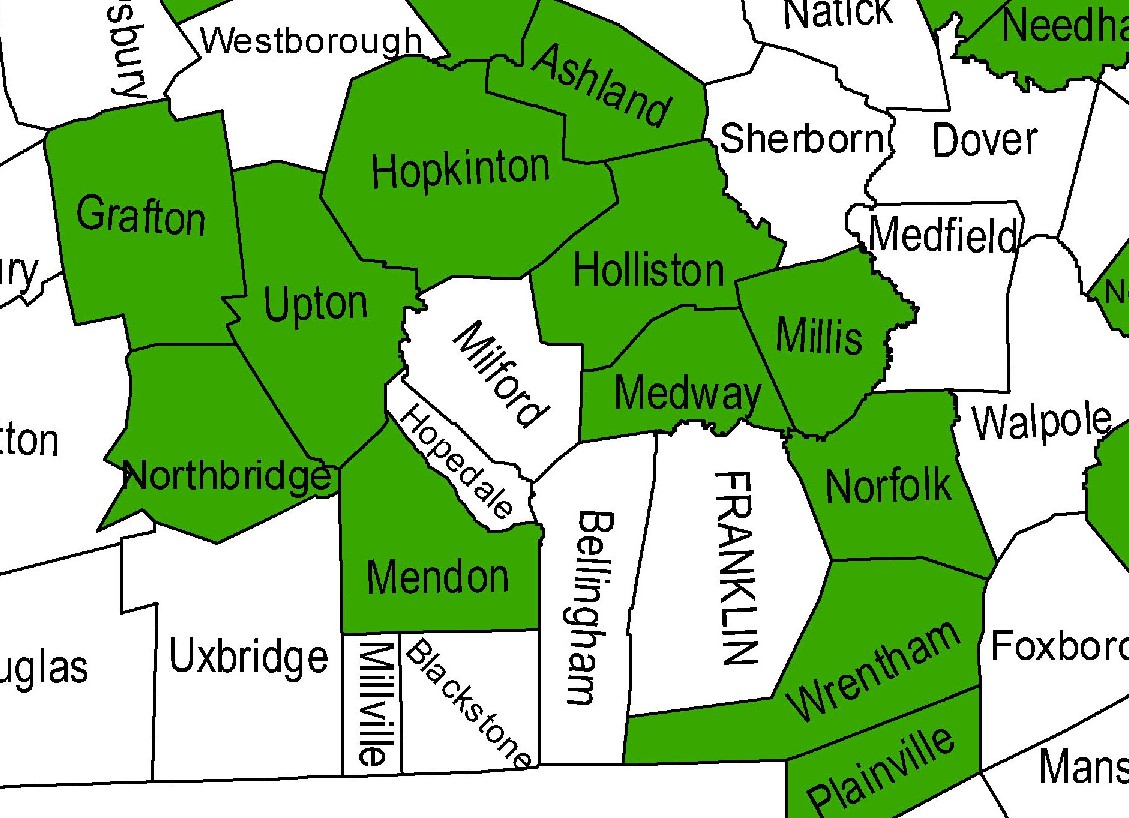

Franklin, MA Town Administrator Jamie Hellen recently made a presentation to the Franklin Town Council advocating that Franklin consider participating in the Massachusetts Community Preservation Act (CPA). In the region of Massachusetts immediately surrounding Franklin, a number of towns have already enacted the CPA (shown in green below).

Local property tax surcharge with matching funds from the Commonwealth

One of the key features of the CPA is a requirement that participating cities and towns raise additional revenue via real property taxes (in the form of a surcharge of between one percent and three percent of the community’s real estate tax levy). The CPA mandates that the surcharge monies raised are spent within the community for community preservation purposes, including building affordable housing, improving recreational resources, creating open space, and preserving historic buildings and other assets.

To encourage participation in the CPA, the Commonwealth contributes annual matching funds to participating municipalities. These matching funds currently amount to approximately one quarter of the annual revenues each city and town raises under the CPA program.

Benefits of CPA participation

The Community Preservation Coalition, an advocacy group supporting the CPA, maintains a website that highlights a selection of community preservation projects completed under the CPA.

While the recaps of these projects tell engaging stories accompanied by attractive photos, they may not adequately convey to Franklin residents the practical, local benefits of CPA participation.

How Medway has used CPA funding

A look at how the neighboring Town of Medway, MA, one town to the north of Franklin, has used CPA funding can demonstrate to Franklin residents in a more concrete way how the CPA can help enhance the livability of participating communities.

Medway has spent CPA funding on many community preservation projects in the last decade (the projects shown above are just a sample). The projects completed include new amenities at playgrounds, major improvements at town parks, new tennis courts at the middle school, additional open space with walking trails, affordable housing units, and the rehabilitation of a historical building at risk of demolition.

Unintended consequences of Proposition 2 1/2 create need for CPA

Of the 351 cities and towns in Massachusetts, half (176 as of early 2020) have chosen to participate in the CPA since it was implemented in 2001. The primary motivation behind all those communities’ participation in the CPA seems to be the severe constraints put on municipal finances imposed by Proposition 2 1/2.

You can use the hotlink at right or in the image above to download the Center on Budget and Policy Priorities’ scathing analysis of the unintended consequences of Massachusetts’ Proposition 2 1/2.

Adopted in 1980 during a popular taxpayer revolt against what was seen as rampant over-taxation in “Taxachusetts”, Prop 2 ½ severely limits the ability of Massachusetts cities and towns to fund their operations via real property taxes. The results of this cap on local taxation of real estate are described in the Center’s report as follows:

“By limiting Massachusetts localities’ only major source of revenue, Proposition 2 ½ has exacted a considerable cost — one that highlights the shortcomings of property tax revenue caps as a policy approach. The law has:

1. Arbitrarily constrained local governments’ ability to raise revenues without any consideration of the actual cost of providing services;

2. Made local governments heavily dependent on state aid, which tends to fluctuate with economic cycles and state policies (a particular problem in an economic downturn when state aid usually declines but the need for local services such as education and fire and police protection does not decline);

3. Exacerbated disparities between wealthier communities and poorer ones in access to quality local services, as many of the former have voted to override Proposition 2 ½’s revenue cap while the latter have generally had to adhere to it; and

4. Resulted in cuts to valued services rather than simply calling forth greater efficiency from local governments.”

Hence the interest in the CPA by cities and towns as a mechanism to raise some local tax revenue outside of the constraints of Prop 2 1/2. The benefits of the CPA to taxpayers are that the CPA funds are kept under local control and can only be spent on preservation projects in the community. State government bureaucrats in Boston do not determine how each participating community’s CPA monies are spent.

How much CPA participation could cost Franklin taxpayers

The CPA contains complex directives on how the various surcharge amounts on a community’s real estate tax levy are calculated. (These detailed directives are not reviewed in this post, but you can read the CPA law itself here and access the explanations provided by the Community Preservation Coalition here.)

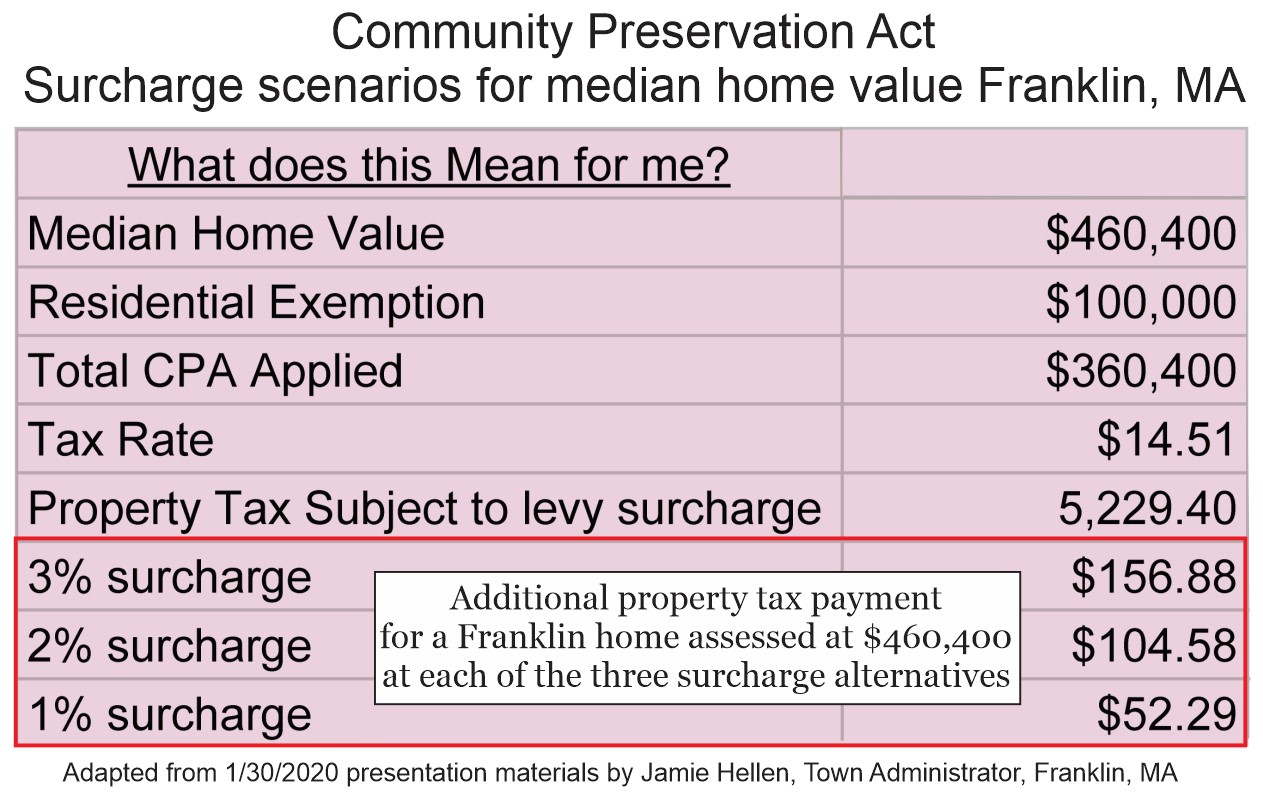

To supplement his presentation to the Franklin Town Council earlier this year, Town Administrator Hellen created detailed spreadsheets showing how the CPA real estate tax surcharge would be applied in Franklin. Below is a very simplified excerpt from Administrator Hellen’s spreadsheets:

As shown above, for a home in Franklin with the median assessed value of $460,400, the three alternative CPA surcharges would add the following amounts to the homeowner’s real property tax bill: $156.88 per year (3% surcharge); $104.58 per year (2% surcharge); and $52.29 (1% surcharge). The amounts would be higher for Franklin homes assessed above $460K and lower for homes assessed below $460K. (Note that the first $100K of property value is exempt from the surcharge and that low-income homeowners do not pay the surcharge.)

Matching funds from the state

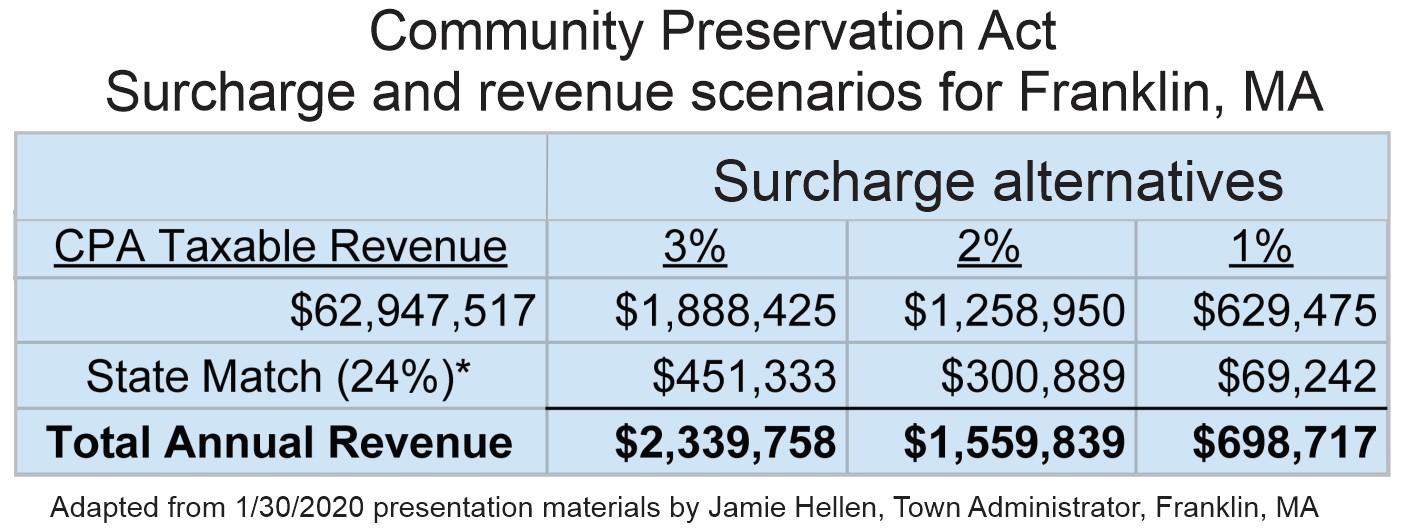

As an incentive for cities and towns to participate in the CPA, each year the Commonwealth of Massachusetts provides matching funds to participating communities. The rules on how much each community receives are very elaborate and extensive and are not addressed in this post. (Again, the CPA law can be found here and the website maintained by the Community Preservation Coalition has detailed information on this.)

The above chart was created by Franklin Town Administrator Jamie Hellen as part of his presentation to the Town Council. It shows how much revenue Franklin would generate under each of the three surcharge alternatives and the amount of matching funds Franklin would receive from the state under each alternative. There may be an error in the chart regarding the amount of matching funds under the 1% surcharge (24% of $629,475 is $151,074, not $69,242).

Looking at the two charts together, you can see that if Franklin adopts a 2% surcharge, the town would have just nearly$1.6M in CPA funds (surcharge plus matching funds) and the cost of this to Franklin taxpayers would be $104.58 in extra real estate taxes per residence (at the $406,400 median assessed value). A 3% surcharge would yield over $2.3M in CPA funds at a cost of an additional $156.88 in real estate taxes per median-assessed-value residence.

Pros and Cons of the CPA

The Pros: Clearly, community preservation (in the form of spending for recreational resources, open space, preserving historic buildings and building affordable housing) is a worthy cause. And some would say that the 1%, 2% and even the 3% surcharge is a small burden for taxpayers to bear, especially given that low-income homeowners are exempt from the surcharge’s extra taxation. The fact that the state contributes matching funds (currently about 24% of the amount each community raises with its tax surcharge) creates an incentive for Franklin to join the ranks of cities and towns participating in the CPA. While Franklin does very well with its recreational resources without the CPA, the extra community preservation spending would help make Franklin even more attractive and livable. The spending would bolster the appeal of Franklin to home buyers, supporting home values.

The Cons: Many families live paycheck to paycheck. A real property surcharge would be a significant extra expense for these households. And most taxpayers very likely have many other good uses for the money a surcharge would take out of their pockets. In addition, one could validly say that any additional tax revenue authorized in Franklin might better be spent on Franklin’s public schools, instead of on additional community preservation projects.

Whatever side of the CPA participation question you tend to favor, you need to keep the unintended consequences of Proposition 2 1/2 in mind. Massachusetts cities and towns are so limited in tax revenue due to Prop 2 1/2 that important governmental functions on the local level have been starved of funding for decades. The CPA offers Franklin a restricted and controlled way around the chokehold Prop 2 1/2 has on town revenues. Franklin’s participation in the CPA deserves your careful consideration.

©2020 02038.com