The Massachusetts real estate market is currently a feast for home sellers. Demand for homes – and home sale prices – continue to soar in 2018.

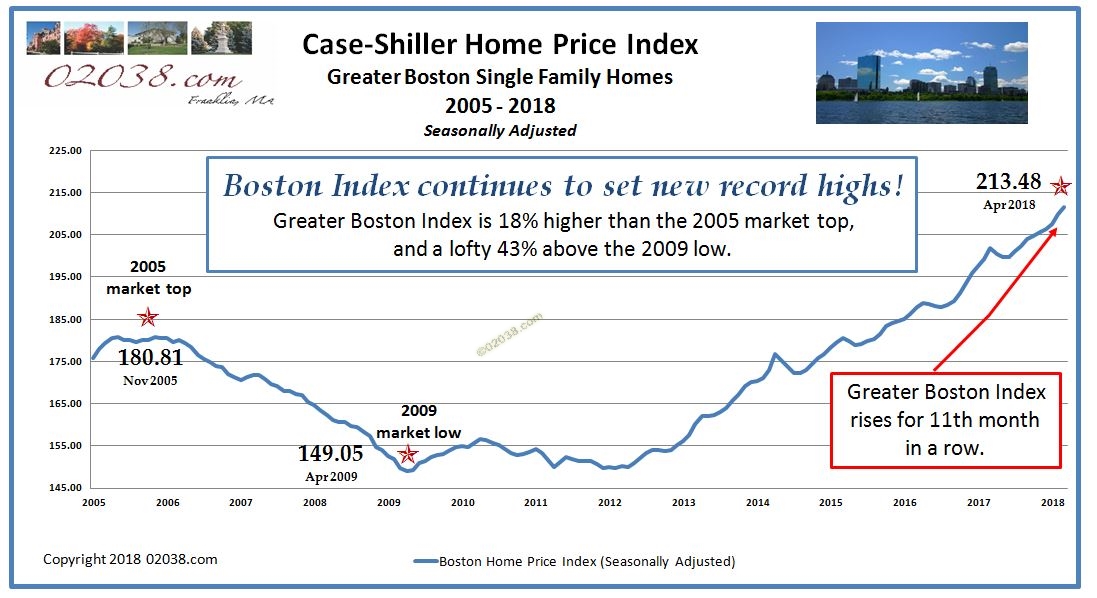

The Case-Shiller Home Price Index for Greater Boston has risen for 11 straight months, and has been powering upward since 2012. At its most current reading of 213.48, the Index is 18 percent higher than its prior high point back in 2005, at the top of the last market cycle. The Index now stands 43 percent above where it was in 2009, the most recent market bottom.

Boston Bubble or are high prices endemic to Greater Boston?

Current conditions in Eastern Massachusetts are so robust that the “B-word” is being bandied about in the media: There is talk about the possible beginnings of a real estate bubble in Greater Boston.

A recent editorial in the influential real estate trade publication Banker & Tradesman sought to contradict the new Boston Bubble theory.

Banker & Tradesman argues that the current low housing inventory and high home prices in Greater Boston are a natural function of supply and demand. The editorial asserts that the booming Massachusetts economy has created so many new jobs and drawn so many new residents to the Bay State that demand for housing is overwhelming supply. It’s the excess demand for housing, created by the vibrant MA economy, that is driving the real estate market upwards, not the speculative frenzy that characterizes an economic bubble.

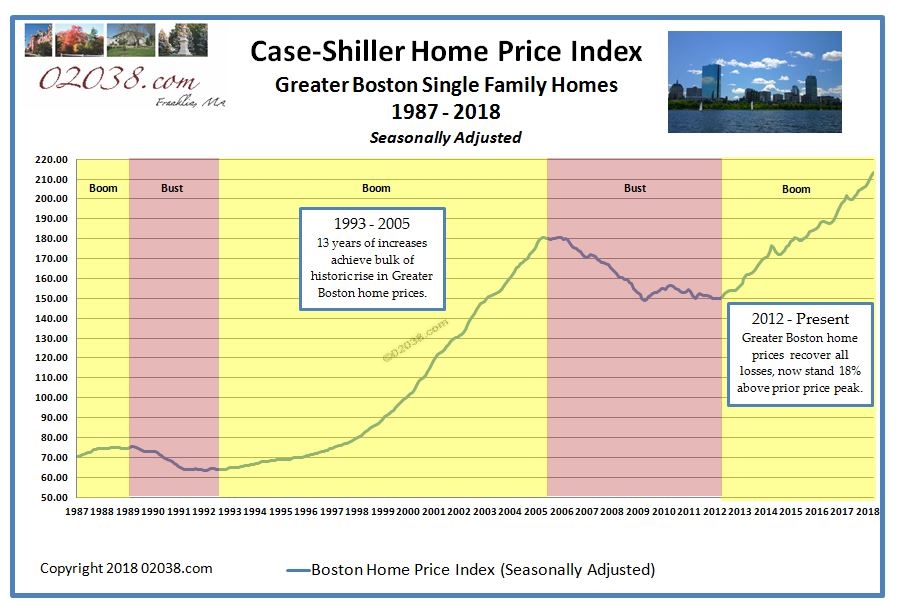

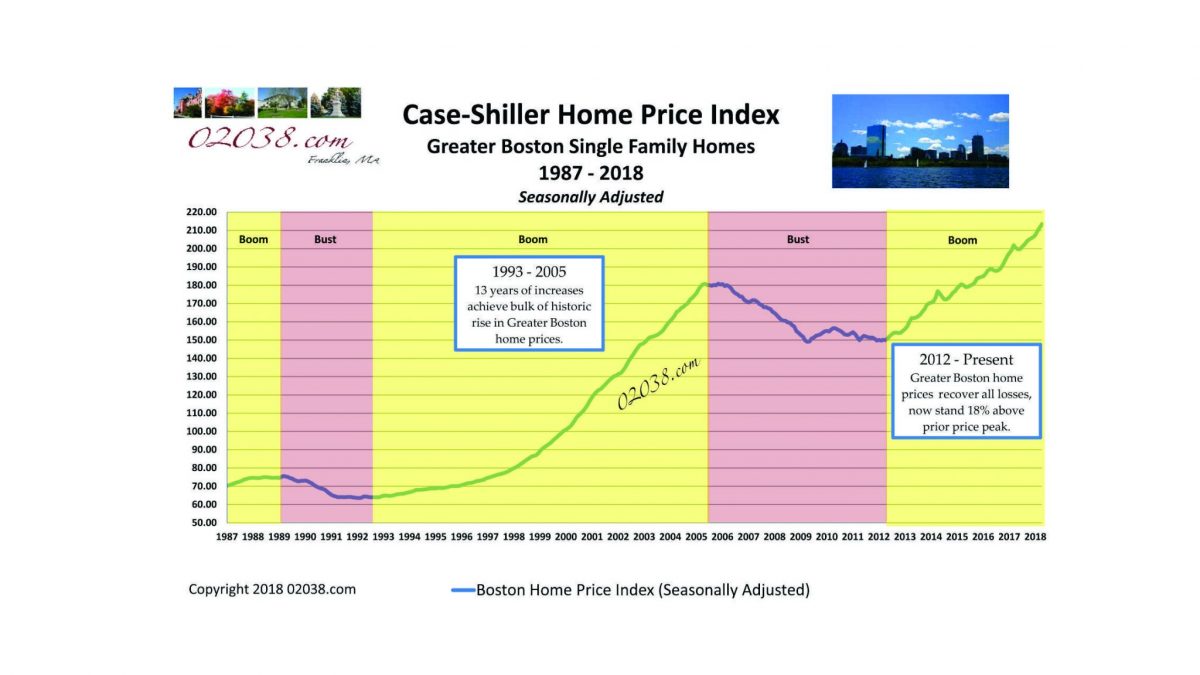

Longer view of the MA housing market cycle

That the folks at Banker & Tradesman are analyzing the Greater Boston housing market correctly becomes clear when one takes a longer term view of the market’s performance.

The bulk of the historic rise in Greater Boston home values over the last 30+ years took place during the 13-year-long bull real estate market of the 1990s and early 2000s. From a low of 63.56 in February 1992, the Boston Index rose 185 percent to a high of 180.81 in November 2005. Even the vicious Great Recession of 2007 – 2009, the worst national economic catastrophe since the Great Depression, failed to undo the majority of those gains. The Massachusetts real estate market was badly dented by the Great Recession, but it did not break. Since 2012, the Boston Index has recouped all its losses and has moved on to new highs

Don’t bet against the MA real estate market

The knowledge-based Massachusetts economy lies at the heart of the Greater Boston real estate market’s amazing price performance since the mid-1980s. And with the advent of the life sciences and biotech industries in the Bay State, it seems highly unlikely that the Commonwealth’s economy will become moribund in coming decades. Boston does not appear likely to suffer a decades-long loss of jobs and population along the lines of Detroit!

My point is that a future downturn in the Massachusetts real estate market (and there surely will be one) will be cyclical, not permanent. A future downturn, even as severe as the one during the Great Recession, will not obliterate the enormous home price gains of the last 30 years. Yes, there will be ups and downs in MA home prices as economic expansions and recessions unfold in the future – that’s only natural. But the overall trend in Massachusetts home prices seems inexorably on the upside. The overall uptrend in homes prices will endure for a good, beneficial reason: the Massachusetts economy makes the Commonwealth a wonderful place to build both a career and a future!

So the best advice to be given to today’s beleaguered home buyers is: don’t try to time the real estate market! Buy a home when the time is right for you. Don’t succumb to the temptation to put off buying in hopes that home prices will be significantly lower at some point in the future. Remaining a renter and paying high rents for years in hopes that home prices will fall is a losing proposition.

Yes, another economic downturn will come. And yes, Massachusetts home values, at that time, will surely take a hit. But, just as surely, another boom cycle in home prices will come as the economy recovers, as it always will.

Copyright ©2018 02038.com